Integration

In-depth knowledge

Testing and Go-live

In-depth Knowledge

Transaction states

Transactions represent fund movement such as payments, refunds, and payouts. This guide provides an overview of transaction states, explaining their significance and outlining recommended actions. Crucially, you will also see which states trigger notifications and which do not.

Payments

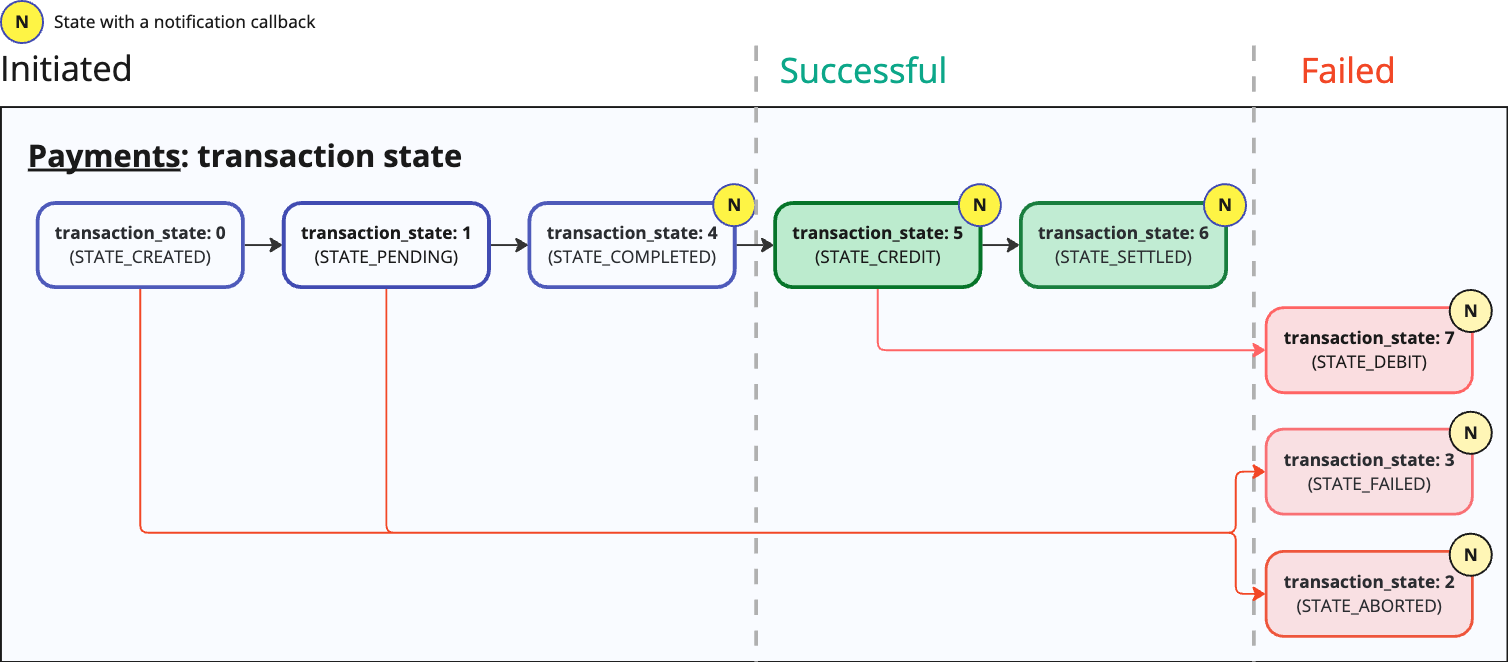

Payments state flow

Example of a transaction_state notification posted to the callbacks.url

POST [url] // EXAMPLE: POST /callback/?order_id=ORD-12345-ABC

user-agent: Brite Callback

content-type: application/json

accept-encoding: gzip, deflate

{

"merchant_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSCE1lcmNoYW50GICAgID4woQKDA",

"transaction_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSC1RyYW5zYWN0aW9uGJX6itYBDA",

"transaction_state": 6 // STATE_SETTLED

}

You should store the transaction_id alongside the order in your system.

transaction_state*

|

Transaction state name | Description | What to do? | Notification? |

|---|---|---|---|---|

0

|

STATE_CREATED

|

Payment created in Brite’s system The first state of a deposit transaction. Transaction is created after the user has completed the KYC and selected the account to be debited. |

- | - |

1

|

STATE_PENDING

|

Payment ready for authorisation Occurs after merchant approval (if approval_required is set) and Brite risk engine (customer age, merchant blocklist, Brite blacklist) has been passed. |

- | - |

2

|

STATE_ABORTED

|

Payment failed with a reason. Please note: The transaction can still be settled at a later stage, so callbacks should still be listened to. | Return to the payment selection view. | Yes |

3

|

STATE_FAILED

|

Payment failed unknown. Please note: The transaction can still be settled at a later stage, so callbacks should still be listened to. | Return to the payment selection view. | Yes |

4

|

STATE_COMPLETED

|

Authorisation completed The customer has completed all required steps to authorise the payment. At this point, the bank needs to further process the payment. |

Confirm the order / purchase to the customer. | Yes |

5

|

STATE_CREDIT

|

Payment processed for sending The payment is now fully processed for sending. If the payment amount is equal or below the configured exposure limit in your merchant configuration, this state will trigger together with state 4.

|

Ship goods / credit the player. | Yes |

6

|

STATE_SETTLED

|

Payment arrived (fully settled) - final state

The payment was received in full and the funds are now scheduled to be paid to the merchant. |

- | Yes |

7

|

STATE_DEBIT

|

Payment lost - final state

This can happen in rare cases, most often due to technical or other reasons. If the payment wasn’t received within a certain number of days, Brite will automatically declare the payment failed. |

Reach out to the customer to pay again. | Yes |

* only the numerical transaction_state is shared in the notification.

You can reduce the risk to payment failure to virtually zero if you wait for state 6 (STATE_SETTLED) to ship goods or credit the player.

While state 5 indicates that payment was sent, 6 means that the payment has arrived in full and it can’t be returned anymore. This, however, can take a couple more minutes or even to hours.

Unexpected successful payments

In rare cases a bank might label a payment wrongly as failed. Brite then sets the payment into the state 2 or 3 (STATE_ABORTED or STATE_FAILED) to then actually still receive the payment. This means that the customer actually paid successful and Brite received the funds. As a result, this payment is then updated to first to state 5 (STATE_CREDITED) and then 6 (STATE_SETTLED), meaning you still receive those notifications for this payment.

While Brite has systems to minimize these issues, we advise adding your own handling logic. Consider:

-

Initiating a refund if the customer has made a duplicate payment.

-

Contacting the customer to confirm how they wish to proceed with the funds.

Payouts and refunds

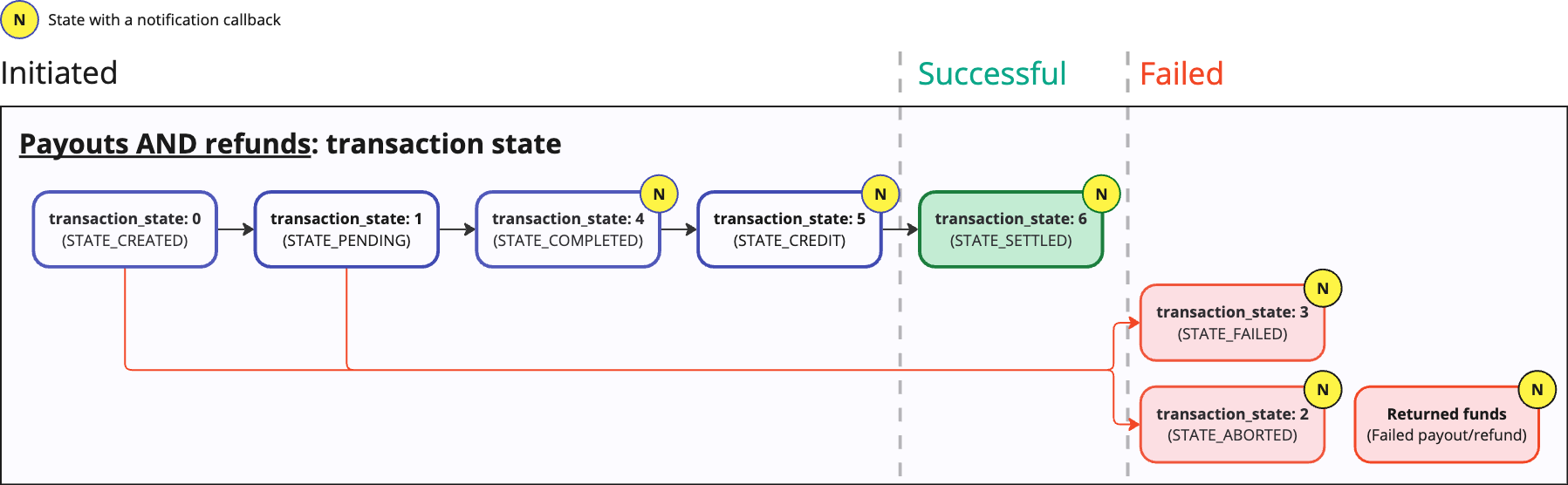

Payouts and refunds state flow

transaction_state

|

Transaction state name | Description | What to do? | Notification? |

|---|---|---|---|---|

0

|

STATE_CREATED

|

Payout/refund created in Brite’s system The first state of a deposit transaction. Transaction is created after the user has completed the KYC and selected the account to be debited. |

- | - |

1

|

STATE_PENDING

|

Payout/refund ready for authorisation Occurs after merchant approval (if approval_required is set) and Brite risk engine (customer age, merchant blocklist, Brite blacklist) has been passed. |

- | - |

2

|

STATE_ABORTED

|

Payout/refund failed with a reason - final state | - | Yes |

3

|

STATE_FAILED

|

Payout/refund failed unknown - final state | - | Yes |

4

|

STATE_COMPLETED

|

Payout/refund completed Brite completed all required steps to send the payouts/refunds. At this point, the bank needs to further process the payment. |

Confirm the payout / refund to the customer. | Yes |

5

|

STATE_CREDIT

|

Payout/refund processed for sending The payment is now fully processed for sending. |

- | Yes |

6

|

STATE_SETTLED

|

Payout/refund was sent - final state

The payout/refund was sent and is now expected to arrive on the customer’s bank account. This typically take only couple of seconds or minutes but Brite has no way to |

Mark the payout/refund as completed (if not already done before) |

Yes |

| - | - |

Payout/refund failed - final state

The payout/refund failed and the funds were returned back to Brite. Your merchant balance was updated. See returned funds Note this state is not part of the regular notification and funds flow. To get notifications, you need to configure the "returned funds notification" in the Brite Back Office. |

Reach out to the customer to choose another bank account or contact their bank. | Yes |

Special handling in Sweden

In exceptional rare cases, payouts in Sweden can remain in STATE_PENDING = 1 for longer than anticipated. To avoid unnecessary delay, you should subscribe to STATE_COMPLETED = 4 , meaning that the payout has passed the STATE_PENDING and giving you a way to identify the remaining payouts.

Returned Funds Notification

If a refund or payout to a customer fails and is sent back to Brite (even after it initially seemed successful), Brite will return those funds to your (the merchant's) account and update the balance accordingly. This means you will have the money back, but your customer won't have received their refund or payout. To inform you about such cases, Brite sends a notification to the URL that you configured in the Back Office (called "returned funds notification url") if this happens.

Example of the returned funds notification

POST [back_office_configured_url]

user-agent: Brite Callback

content-type: application/json

accept-encoding: gzip, deflate

{

"merchant_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSCE1lcmNoYW50GICAgID4woQKDA",

"transaction_id": "ag9ofmFib25lYS0xNzYyMTNyFAsSB1Nlc3Npb24YgICAjeqInQgM",

"original_transaction_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSC1RyYW5zYWN0aW9uGJX6itYBDA",

"notification_type": "RETURNED_TRANSACTION",

"country_id": "se",

"amount": 299.95

}

What to do with returned funds?

original_transaction_id. This way you can label the original refund or payout as failed and highlight it in your system.

There are different reasons for that, and while Brite is most often not informed about the actual reason, some examples are:

- Bank account does not exist

- Bank account closed or blocked

- Format of the bank account number is not correct

- Other unknown reasons

- Asking the customer to choose another bank account or

- Asking the customer to reach out to their bank.