Integration

In-depth knowledge

Testing and Go-live

Integrate

Brite Instant Payouts

This guide explains how to integrate Brite’s Instant Payouts API to send funds directly to your customers’ bank accounts.

bank_account_id).

- Merchant authorization

POST /api/merchant.authorize - Create a Bank Account (if you don’t have a bank account id already)

POST /api/bank_account.createorPOST /api/session.create_bank_account_selection - Initiate a Payout

POST /api/transaction.create_withdrawal - Handle Callback Notifications

POST [callbacks[...].url]POST /api/transaction.get - Handle Returned Funds Notifications

How to get a bank_account_id?

There are three ways to obtain a bank_account_id:

- From a previous payment:

If the customer has previously made a payment using Brite, you can retrieve their bank_account_id by fetching the transaction details using POST /transaction.get. - Create a bank account via API:

You can create a new bank account record directly via the API if you have all the required bank account details available. - Create a bank account via the Brite Client:

Guide the user through the Brite Client to select or add their bank account using session.create_bank_account_selection.

Here we focus on the 2nd option, creating a bank account via the API.

POST /api/merchant.authorize

You need to authorise your access to Brite’s APIs. For that, follow the steps outlined in Authorisation. As a result, you have an access_token which you add to your requests to the Brite APIs.

Authorization: Bearer <access_token>

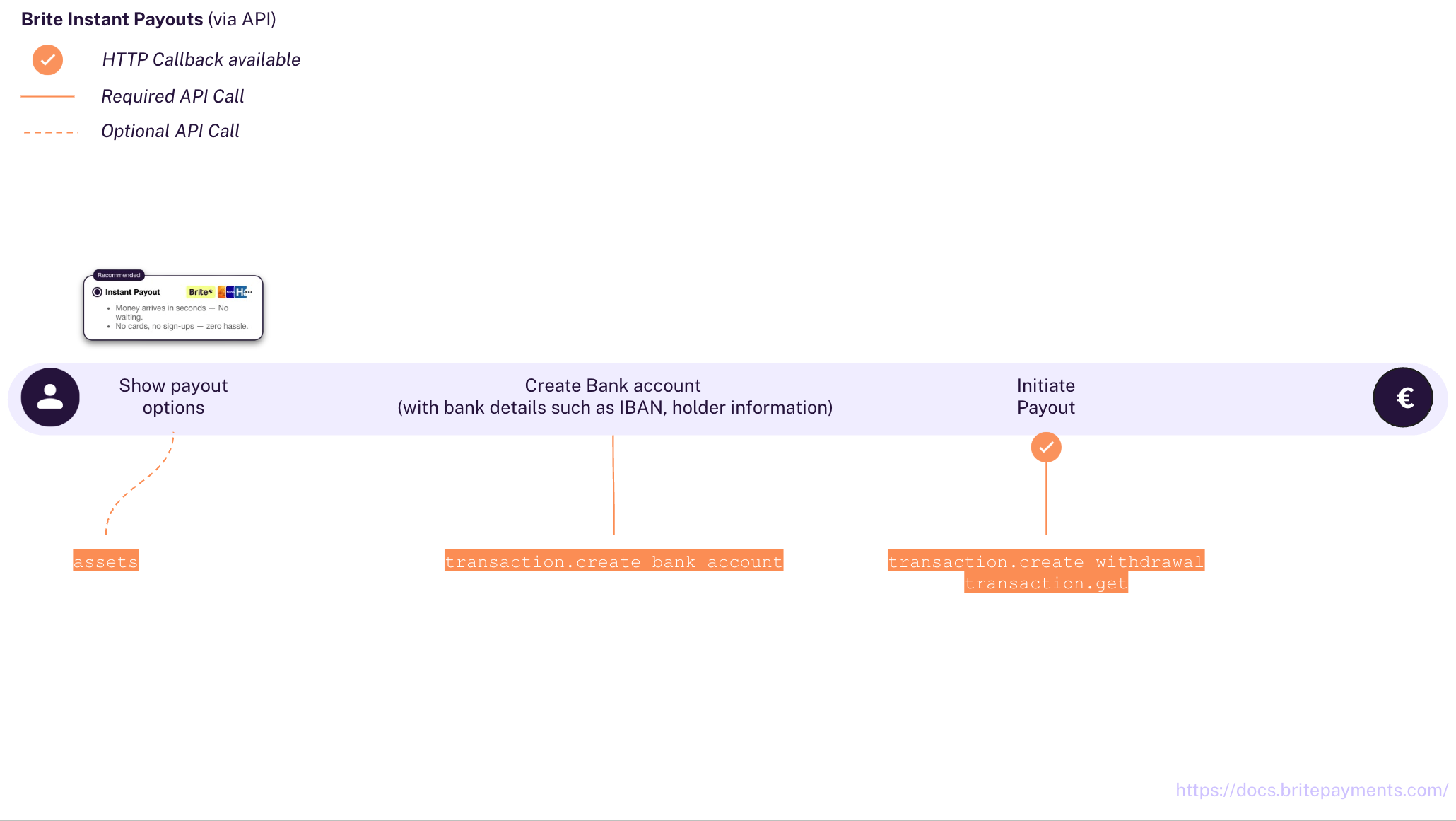

Create a Bank Account via API

If you don’t have a bank_account_id for the customer and choose not to use the session flow, you must first create one using the POST /bank_account.create endpoint.

POST /bank_account.create

POST /bank_account.create HTTP/1.1

hostname: sandbox.britepayments.com

Authorization: Bearer <YOUR_TOKEN>

{

"country_id": "de",

"iban": "DE89370400440532013000",

"holder_firstname": "Hans",

"holder_lastname": "Schmidt",

"holder_dob": "1978-03-22",

"holder_address": {

"city": "Berlin",

"postal_code": "10115",

"street_address": "Musterstraße 1",

"country": "Germany"

}

}

For a full list of all parameters check out the API reference.

Importance of Customer Data

When creating a bank account via the API, providing accurate customer details (holder_firstname, holder_lastname, holder_dob, holder_address) is crucial for every request.

- Compliance: Supplying this data helps meet Know Your Customer (KYC) requirements.

- Payout Success: Accurate holder information can reduce the risk of payouts being rejected or delayed by the receiving bank.

Ensure you collect and provide the most accurate and complete customer information available when using this endpoint.

Understanding BBAN (for Sweden & Denmark)

The bban (Basic Bank Account Number) parameter is used instead of iban when country_id is "se" (Sweden) or "dk" (Denmark).

Format in Sweden:

The bban must be a concatenation of the Clearing Number and the Account Number, with no spaces or separators.

- Clearing Number (Clearingnummer): Typically 4 digits (sometimes 5 for Swedbank).

- Account Number (Kontonummer): Variable length, usually 7-10 digits.

Format in Denmark:

The bban should be the standard Danish BBAN (often referred to as Reg.nr + Kontonummer, but provided as a single BBAN string according to Danish standards). No special concatenation is required by Brite beyond the standard format.

Response from /bank_account.create

{

"id": "ag9ofmFib25lYS0xNzYyMTNyFAsSB1Nlc3Npb24YgICAtevC9wOM"

}

The API will respond with the id of the newly created bank account.

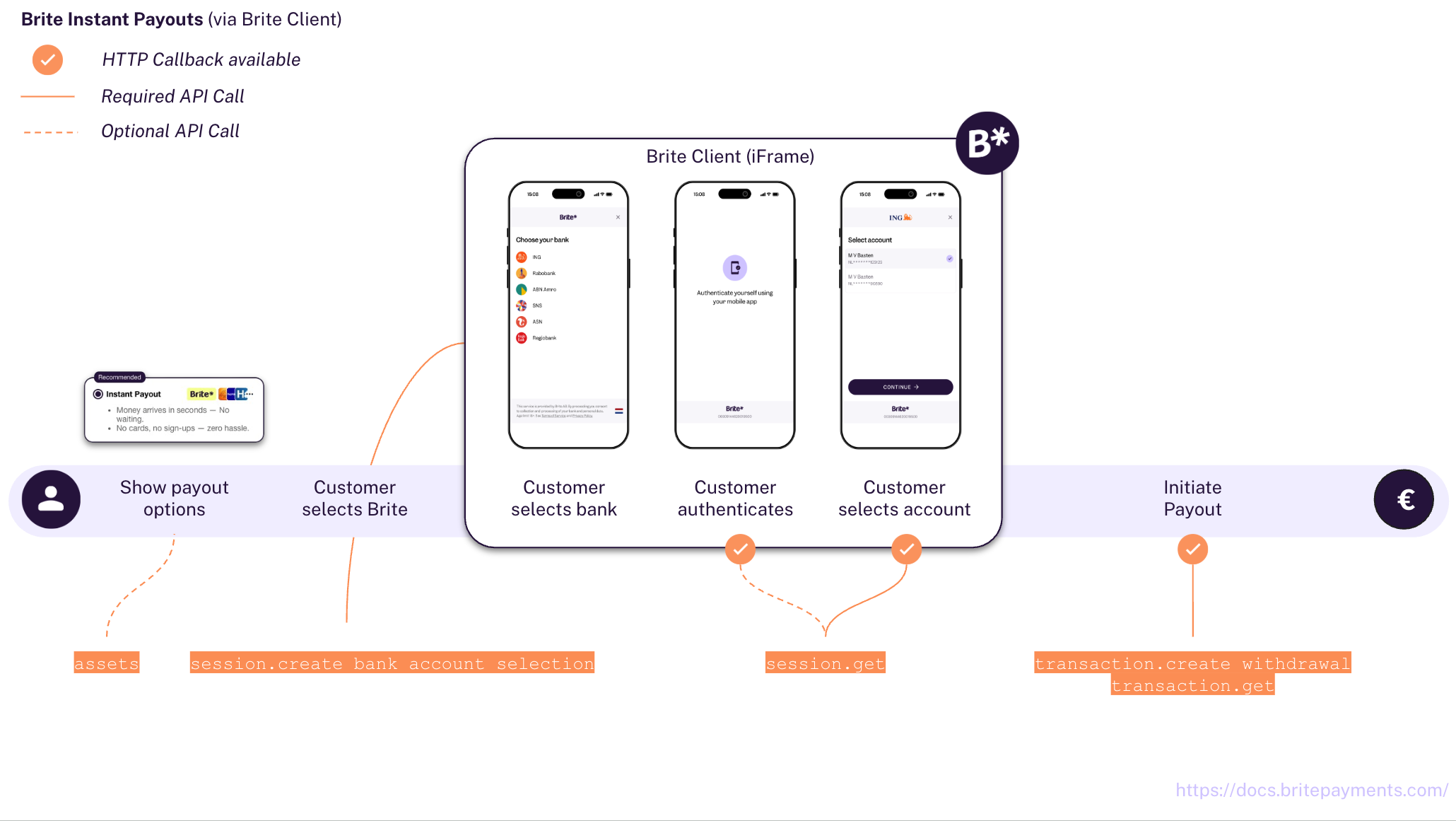

Create Bank Account via Session (Brite Client)

If you don’t have a bank_account_id for the customer and choose to use the Brite Client to retrieve one from your customer, you must use the POST /session.create_bank_account_selection endpoint. This approach initiates a session using the Brite Client where the user can select their bank and consent to sharing their account details. Upon successful completion, Brite provides the resulting bank_account_id, which you can then use for payouts. This method simplifies the process for you as Brite handles the bank selection UI and account detail retrieval directly from the user.

For detailed instructions on implementing this flow, please refer to the Bank Account Selection guide.

bank_account_id, initiate the payout using the POST /transaction.create_withdrawal endpoint. Request: POST /transaction.create_withdrawal

POST /transaction.create_withdrawal HTTP/1.1

hostname: sandbox.britepayments.com

Authorization: Bearer <YOUR_ACCESS_TOKEN>

{

"amount": 199.50,

"bank_account_id": "ag9ofmFib25lYS0xNzYyMTNyFAsSB1Nlc3Npb24YgICAtevC9wOM",

"merchant_reference": "PAYOUT-REF-45678",

"statement_reference": "Your payout from Merchant ABC" // REMOVE for SE and FI payouts

"callbacks": [

{

"url": "https://your-merchant-site.com/callbacks/brite?order=45678",

"transaction_state": 2

},

{

"url": "https://your-merchant-site.com/callbacks/brite?order=45678",

"transaction_state": 3

},

{

"url": "https://your-merchant-site.com/callbacks/brite?order=45678",

"transaction_state": 4

},

{

"url": "https://your-merchant-site.com/callbacks/brite?order=45678",

"transaction_state": 6

}

]

}

Here we highlight some key parameters from the transaction.create_withdrawal request above. For a full list of all parameters, please consult the API reference.

merchant_reference

This is your internal reference for the transaction. While it can be any relevant string, setting it to a unique identifier for each payout attempt (unique per amount) enables idempotency.

statement_reference

This optional field allows you to specify a reference text that appear on the recipient’s bank statement. Important: This parameter cannot be used for payouts to Sweden (SE) or Finland (FI). The statement_reference should not exceed 105 characters. Typically banks accept up to 140 characeters for such references and since Brite requires up to 35 characters for the RF-id, it leaves 105 characters for the merchant.

While Brite and our integrators fully support the 140-character SEPA limit for remittance information, the final display and processing are determined by the recipient bank. Despite SEPA regulations, some banks may truncate long references in certain channels (such as mobile apps) or prioritize structured over unstructured fields. Since these display choices and internal processing rules are at the recipient bank’s discretion, they remain outside of Brite’s control.

Response from /transaction.create_withdrawal

{

"id": "ag9ofmFib25lYS0xNzYyMTNyFAsSB1Nlc3Npb24YgICAjeqInQgM",

"eta": 1739956658

}

The API will respond with the id of the newly created payout transaction and an estimated time of arrival (eta).

Brite sends POST requests to the callback URLs provided in the transaction.create_withdrawal request (see Step 3) when the transaction reaches specific states (STATE_ABORTED, STATE_FAILED, STATE_COMPLETED, STATE_SETTLED).

Detailed information on how to receive, validate, and process these notifications is available in the dedicated callback handling documentation:

Integrate Callback Handling (Covers processing state updates, security, and best practices)

In some rare cases, a payout might be returned by the bank after initially being settled (e.g. due to incorrect account details). Brite will notify you via a specific callback if you have configured one for returned funds.

{

"transaction_id": "ag9ofmFib25lYS0xNzYyMTNyFAsSB1Nlc3Npb24YgICAjeqInQgM",

"original_transaction_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSC1RyYW5zYWN0aW9uGJX6itYBDA",

"notification_type": "RETURNED_TRANSACTION",

"merchant_id": "ag9ofmFib25lYS0xNzYyMTNyFQsSCE1lcmNoYW50GICAgID4woQKDA",

"country_id": "se",

"amount": 299.95

}

Action: Handle this notification by reconciling the returned funds and potentially contacting the customer to resolve the issue or find an other way to pay out the customer.

Testing Your Integration

Thorough testing is crucial before going live. Ensure you test the following scenarios in Brite's test environment:

Successful Payout

- Create a bank account via API (if applicable).

- Initiate a payout using

transaction.create_withdrawal. - Receive and correctly process the

STATE_SETTLED(6) callback. - Verify transaction details using

transaction.get.

Failed Payout

- Trigger failure scenarios via the API. See the Integration Test and Verification page for details on the specific test data or parameters to use.

- Receive and correctly handle

STATE_ABORTED(2) orSTATE_FAILED(3) callbacks (as detailed in the Callback Handling guide).

Returned Funds

- Trigger returned fund scenarios via the API in the test environment. See the Integration Test and Verification page for details on how to trigger these scenarios.

- Receive and correctly process the

RETURNED_TRANSACTIONnotification from the BackOffice-configured URL.

Idempotency

- Verify idempotency using the

merchant_referencefield intransaction.create_withdrawal. The primary benefit is to prevent accidental duplicate payouts if the same request is sent multiple times due to network issues or retries. - If you send a request with a

merchant_referencethat has been used previously with the same amount, Brite will return thetransaction_idof the original transaction instead of creating a new one. - If you send a request with a previously used

merchant_referencebut with a different amount, Brite will return an error. - Test both scenarios to ensure your system handles them correctly.

This documentation provides a guide based on the information in the supplied files. Remember to consult the full API reference for detailed parameter descriptions, error handling, and additional options.