Integration

In-depth knowledge

Testing and Go-live

Testing and Go-live

Integration test

Technical

- For each API method, please be sure to send all the parameters and attributes as described in the documentation.

- Make sure you listen to the right callback notifications for the product you integrated with and you react on the statuses accordingly

- In the event of an API error, please ensure your system logs the corresponding error code and that your team investigates the matter internally

UX / UI

- The Brite Client must be presented in the correct way as described in our Checkout Guidelines.

- Ensure that the whole end-to-end customer journey is implemented in a seamless way accross all platforms (mobile website, desktop and mobile app)

To ensure a robust integration, Brite provides a comprehensive suite of test cases that cover both successful (‘happy path’) and error (‘unhappy path’) scenarios, preparing your system for virtually any event.

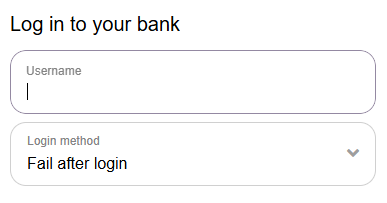

The Brite Client allows you to select certain test scenarios to trigger specific behaviours such as a successful one or aborted attempts (due to a failed login, risk engine rejection, underaged customer, etc). You can find those test cases by selecting the “Test Bank” in the Brite Client in the Sandbox environment.

In this section you can find the most important things to verify if you integrated the Brite Client correctly. These tests apply for all products which use the Brite Client.

- Brite is shown to all customers in order to not discriminate anyone

- The Brite Client is rendered on all platforms in the correct size

- It occupies the full screen on a mobile device

- No scrollbars are visible in the Brite Client

- There are no additional ways to close or exit the Brite Client other than the [x] in the Brite Client

- In case the Brite Client is closed, the customer ends up on a page where he can proceed his journey

In this section you can find the most important test cases to verify your Brite Instant Payments (incl. refunds) integration.

PI-01: Successful payment (*)

| Scenario | Initiate a payment and complete it successfully using the Brite Client. |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” or any other working bank |

| Considerations & Verifications | Nothing additionally to the integration guidelines |

PI-02: Unsuccessful payment with aborted status (*)

| Scenario | Initiate a payment and abort it using the Brite Client. |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” and pick an “aborted” test case or simply close the Brite Client by using the [x] |

| Considerations & Verifications |

|

PI-03: Returning user payment (*)

| Scenario | Initiate a payment from an returning user using the Brite Client which will lead to a faster checkout and better conversion |

| Expected Outcome |

|

| How to trigger | Send in a customer_id from a previous payment |

| Considerations & Verifications |

|

PI-04: Status change from unsuccessful to successful payment (*)

| Scenario | Initiate an unsuccessful payment which later on changes to successful |

| Expected Outcome |

|

| How to trigger | Unfortunately this test can’t be triggered on Sandbox yet. |

| Considerations & Verifications |

|

PI-05: Successful refund via API (* if applicable)

| Scenario | Initiate a (partial) refund via API successfully. |

| Expected Outcome |

|

| How to trigger | No specific things to consider here |

| Considerations & Verifications |

|

PI-06: Pending payment

| Scenario | Initiate a payment and complete it successfully using the Brite Client. |

| Expected Outcome |

|

| How to trigger | Every successful payment goes through the complete status before it becomes a successful transaction. |

| Considerations & Verifications | Nothing additionally to the integration guidelines |

In this section you can find the most important test cases to verify your Brite Instant Payout integration.

PO-01: Successful payout via Brite Client (* if applicable)

| Scenario | Select a bank account via the Brite Client and initiate a payout via API successfully. |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” and the “complete” test or any other working bank |

| Considerations & Verifications |

|

PO-02: Successful payout via API (* if applicable)

| Scenario | Initiate a payout via API successfully. |

| Expected Outcome |

|

| How to trigger | No specific things to consider here |

| Considerations & Verifications |

|

PO-03: Unsuccessful payout with aborted status (*)

| Scenario | Initiate a payout which gets aborted. |

| Expected Outcome |

|

| How to trigger | Send an amount of 11.01 or 11.02 in the transaction.create_withdrawal API call |

| Considerations & Verifications | Handle the returned error_code properly and allow the customer to try again if possible |

PO-04: Unsuccessful payout with failed status (*)

| Scenario | Initiate a payout which fails. |

| Expected Outcome |

|

| How to trigger | Send an amount of 12.01 in the transaction.create_withdrawal API call |

| Considerations & Verifications |

|

PO-05: Delayed payout before it settles successfully

| Scenario | Initiate a payout which gets delayed 5minutes before it settles successfully |

| Expected Outcome |

|

| How to trigger | Send an amount of 13.01 in the transaction.create_withdrawal API call. The transaction remains in the state COMPLETED for 5 minutes before it transitions to state SETTLED. |

| Considerations & Verifications |

|

PO-06: Successful bank account creation (* if applicable)

| Scenario | Initiate a creation of a bank_account_id via API successfully. |

| Expected Outcome |

|

| How to trigger | No specific things to consider here |

| Considerations & Verifications |

|

PO-07: Returned funds notification

| Scenario | Initiate a payout which get sent back by the bank as undeliverable. |

| Expected Outcome |

|

| How to trigger | Send an amount of 14.01 in the transaction.create_withdrawal API call. The transaction remains in the state SETTLED for 1 minutes before the callback to the “returned funds notification” is triggered. |

| Considerations & Verifications | Nothing specifically |

In this section you can find the most important test cases to verify your Brite Play integration.

PL-01: Successful payment & registration (*)

| Scenario | Initiate a payment, complete it successfully using the Brite Client and register the user. |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” or any other working bank |

| Considerations & Verifications |

|

PL-02: Aborted payment & registration (*)

| Scenario | Initiate a payment and abort it using the Brite Client. |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” and pick an “aborted” test case or simply close the Brite Client by using the [x] |

| Considerations & Verifications | Handle the returned error_code properly and allow the customer to try again if possible |

PL-03: Handle third-party payments (*)

| Scenario | A payment is initiated by a customer who does not match the customer registered with the merchant. |

| Expected Outcome |

|

| How to trigger |

|

| Considerations & Verifications |

|

In this section you can find the most important test cases to verify your Brite Data Solutions integration.

DS-01: Successfully retrieve bank account information via Brite Client (*)

| Scenario | Select a bank account via the Brite Client |

| Expected Outcome |

|

| How to trigger | Select the “Test Bank” and the “complete” test or any other working bank |

| Considerations & Verifications |

|

In this section we list even more test cases which makes your integration even more stable and provide better experience to your customers.

MO-01: Closed Loop (for payment & payout) (*)

| Scenario | Initiate a payment followed by a closed loop payout to the same customer |

| Expected Outcome |

|

| How to trigger | Use the bank_account_id from a previous payment |

| Considerations & Verifications | Nothing specifically |

When going live, Brite requires a production test to ensure that the integration you built on Sandbox also works fine on production from a UI/UX perspective but also technically. Please provide a screen recording of the testing of an end-to-end flow (both payment and payouts) to our Merchant Solutions team.